casinobonusohneeinzahlung.site Gainers & Losers

Gainers & Losers

Variable Intrest Rate

Which is better? The answer: It depends. Variable rates are typically lower than fixed rates at the time of application. A fixed rate is generally higher to. A variable rate mortgage is a mortgage with a rate that changes. Fortunately, these mortgages don't fluctuate at random. A variable interest rate loan is a loan in which the interest rate charged on the outstanding balance varies as market interest rates change. With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the. Variable interest rate: Variable interest is a type of APR that may fluctuate based on current indexes. The frequency of this may vary depending on current. A variable rate loan is a type of loan where the interest changes according to changes in market interest rates. Also called a variable-rate mortgage, an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance. The structure of variable interest rates incorporates a variable-rate margin and an indexed rate. In the process of margin underwriting, a borrower will be. Adjustable-rate mortgages (ARMs), also known as variable-rate mortgages, have an interest rate that may change periodically depending on changes in a. Which is better? The answer: It depends. Variable rates are typically lower than fixed rates at the time of application. A fixed rate is generally higher to. A variable rate mortgage is a mortgage with a rate that changes. Fortunately, these mortgages don't fluctuate at random. A variable interest rate loan is a loan in which the interest rate charged on the outstanding balance varies as market interest rates change. With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the. Variable interest rate: Variable interest is a type of APR that may fluctuate based on current indexes. The frequency of this may vary depending on current. A variable rate loan is a type of loan where the interest changes according to changes in market interest rates. Also called a variable-rate mortgage, an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance. The structure of variable interest rates incorporates a variable-rate margin and an indexed rate. In the process of margin underwriting, a borrower will be. Adjustable-rate mortgages (ARMs), also known as variable-rate mortgages, have an interest rate that may change periodically depending on changes in a.

The interest rate factor is used to calculate the amount of interest that accrues on your loan. You can find your interest rate factor by dividing your loan's. Variable-rate loan: Your interest rate may change over time in response to changes in market conditions. When interest rates rise, check your current loans. If. Rates for new borrowings (Investment) % p.a. % p.a. % p.a. % p.a. % p.a. % p.a. % p.a. % p.a. % p.a. When you select a variable rate loan, your interest rate will fluctuate over time based on the current index rate. (The Prime index provides the base rate for. A Variable Interest Rate will change during its term, based on market conditions, so the monthly payment on a loan with a variable interest rate, and the amount. The APR calculation assumes a loan of $10,, a fixed interest rate of % or variable interest rate of %, a loan fee BND pays for you and a year. A variable rate mortgage will fluctuate with the CIBC Prime rate throughout the mortgage term. While your regular payment will remain constant, your interest. With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the. A variable rate mortgage will fluctuate with the CIBC Prime rate throughout the mortgage term. While your regular payment will remain constant, your interest. The bank can change your interest rate periodically when the index changes. Your account agreement explains when the bank can make changes to your variable rate. Floating interest rates typically change based on a reference rate (a benchmark of any financial factor, such as the Consumer Price Index). One of the most. FFEL Variable Interest Rates. FFEL Variable Interest Rates resources provide the variable interest rates applicable to Federal Stafford, Federal SLS, and. Variable Interest Rates. Page 2. When someone applies for a variable rate loan, the interest rate is also usually determined at the time of approval – however. A variable interest rate loan is one in which the interest component of the payable loan can fluctuate over time. With a variable rate mortgage, mortgage payments are set for the term, even though interest rates may fluctuate during that time. If interest rates go down. We're breaking down the pros and cons of a fixed vs variable rate, and the importance of leaning on your seasoned lender to help you make the right decisions. A Variable Interest Rate loan has an interest rate on the outstanding balance that rises or falls based on the current status of the market interest rate. On. Almost all education loans offer variable interest rates, so it's important to understand why global lenders use variable rates and how they're formulated. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment.

Above Ground Fallout Shelter

Aboveground Fallout Shelter, Plan H This shelter is for persons who prefer shelter aboveground or for locations where underground shelters are impractical. This luxury bunker also has an above-ground “safe house” insulating the bunker entrance. The structure looks like an ordinary prefab building to the eye. Atlas Survival Shelters produce a wide range of survival shelters, underground bunkers & NBC air filtration systems under your home. Any properly designed and engineered nuclear fallout shelter will always have a shower present before you enter the shelter. The third is an above-ground. ICF bunkers can be installed above ground or partially inground and still offer full protection from ballistic threats and radiation. Steel is easier to. Nuclear, as an abbreviation for weapons of mass devastation. A bomb shelter air filtering system was included in the system from the beginning. Intake hoses. A fallout shelter is comprised of steel, and buried underground to create a livable environment in case of a nuclear blast. Whilst it is possible to have a nuclear shelter in a building above ground, it is normally more suitable and cost effective to construct them underground. We offer the best underground bunkers, storm shelters and safe-rooms on the market. % steel, fabricated by hand and customized to each client's unique specs;. Aboveground Fallout Shelter, Plan H This shelter is for persons who prefer shelter aboveground or for locations where underground shelters are impractical. This luxury bunker also has an above-ground “safe house” insulating the bunker entrance. The structure looks like an ordinary prefab building to the eye. Atlas Survival Shelters produce a wide range of survival shelters, underground bunkers & NBC air filtration systems under your home. Any properly designed and engineered nuclear fallout shelter will always have a shower present before you enter the shelter. The third is an above-ground. ICF bunkers can be installed above ground or partially inground and still offer full protection from ballistic threats and radiation. Steel is easier to. Nuclear, as an abbreviation for weapons of mass devastation. A bomb shelter air filtering system was included in the system from the beginning. Intake hoses. A fallout shelter is comprised of steel, and buried underground to create a livable environment in case of a nuclear blast. Whilst it is possible to have a nuclear shelter in a building above ground, it is normally more suitable and cost effective to construct them underground. We offer the best underground bunkers, storm shelters and safe-rooms on the market. % steel, fabricated by hand and customized to each client's unique specs;.

This shelter is located at a lakefront cottage in Massachusetts. The owner informed me that this was built in or It was built above ground due to. This shelter is located at a lakefront cottage in Massachusetts. The owner informed me that this was built in or It was built above ground due to. Fallout Shelter Music Rehearsal Studio. Funding came from the Federal Civil Defense Agency and from the sale of. Above Ground Fallout Shelter. Leave a comment. Post navigation. Published InAbove Ground Fallout Shelter. Leave a Reply Cancel reply. Your email address will. A bunker built of reinforced concrete with walls 5 feet thick could withstand a 1 megaton ground burst bomb a mile away without being. Blast shelters are a vital form of protection from nuclear attacks and are employed in civil defense. There are above-ground, below-ground, dedicated, dual-. Metal Tornado Safety Shelter. ESP Safety Shelters (above-ground only) offer multi-purpose protection and security for you and loved ones against. You don't need reinforced shelters against fallout; above-ground buildings from the epicenter where a bomb shelter is effective, regardless of weapon yield. fallout shelter with the living arrangements necessary to encourage longevity. Contact us today about extending your home below ground for safety, fun. This document provides construction plans and details for an aboveground home fallout shelter. The shelter is designed to protect a family of six from fallout. 7′ tall, 8′ wide and 30′ long fallout shelter with a 12′ way walkway and above ground blast door. This shelter is being installed on top of a mountain at Smith. Pre-shaped corrugated metal sections or pre-cast concrete can be used for shelters either above or below ground. These are particularly suitable for regions. This shelter is designed to provide low-cost pro- tection from the effects of radioactive fallout. hole can be used if the shelter is assembled above ground. Safe, discrete, inexpensive, DIY/Contractor Installed. You can build a professional engineer certified underground bomb shelter for an in the ground cost. The only limitations in building your ALL steel custom bunker are your budget and your imagination. NBC Air Filtration Systems from the USA, or around the globe. Shelter is the leading safety room manufacturer on the market. Misconception #1: Tornados can blow above ground shelters right off the concrete slab. This. In time, you will be able to leave the fallout shelter. Radioactive Height above the ground the device was detonated. This will determine the. Residential Storm Shelters: The TwisterPod and TwisterPod Max above-ground tornado shelters can withstand EF5 tornado winds. Plans were made, however, to use existing buildings with sturdy below-ground-level basements as makeshift fallout shelters. Above ground buildings with walls. Ground-burst nuclear attacks are designed to kick up as much fallout Sort of- the big caveat to the maps we show above is that those fallout shelters are not.

World Top 10 Forex Traders

Paul Tudor Jones remains among the wealthiest Forex traders around, with his net worth placed around $ billion to $5 billion. The successful trader asserts. FOREX BROKERS LIST ; casinobonusohneeinzahlung.site logo. casinobonusohneeinzahlung.site Best Trading Platforms · · Specialized trading accounts. 24/7 instant money withdrawal ; OANDA logo. OANDA. US. Top 10 best forex traders in the world · 1. George Soros · 2. Stanley Druckenmiller · 3. Bill Gross · 4. Ray Dalio · 5. Carl Icahn · 6. Top 10 Forex Trading Countries · United Kingdom – USD trillion average daily turnover. · United States – USD billion average daily turnover. · Hong Kong –. Take the time to study currency pairs and what affects them before risking your own capital; it's an investment in time that could save you a good amount of. Exness is recognized as the largest broker by trading volume globally, a position it has achieved through a combination of strategic factors. The company offers. As of , George Soros' net worth is estimated at $ billion, making him the richest Forex trader in the world. His wealth is a testament to his strategic. Let experienced professionals teach you how to leverage foreign exchange with a Forex trading course on Udemy. We can help you open a gateway to global. When discussing the richest Forex traders in the world, one name invariably stands out: George Soros. Famously known as “The Man Who Broke the Bank of England,”. Paul Tudor Jones remains among the wealthiest Forex traders around, with his net worth placed around $ billion to $5 billion. The successful trader asserts. FOREX BROKERS LIST ; casinobonusohneeinzahlung.site logo. casinobonusohneeinzahlung.site Best Trading Platforms · · Specialized trading accounts. 24/7 instant money withdrawal ; OANDA logo. OANDA. US. Top 10 best forex traders in the world · 1. George Soros · 2. Stanley Druckenmiller · 3. Bill Gross · 4. Ray Dalio · 5. Carl Icahn · 6. Top 10 Forex Trading Countries · United Kingdom – USD trillion average daily turnover. · United States – USD billion average daily turnover. · Hong Kong –. Take the time to study currency pairs and what affects them before risking your own capital; it's an investment in time that could save you a good amount of. Exness is recognized as the largest broker by trading volume globally, a position it has achieved through a combination of strategic factors. The company offers. As of , George Soros' net worth is estimated at $ billion, making him the richest Forex trader in the world. His wealth is a testament to his strategic. Let experienced professionals teach you how to leverage foreign exchange with a Forex trading course on Udemy. We can help you open a gateway to global. When discussing the richest Forex traders in the world, one name invariably stands out: George Soros. Famously known as “The Man Who Broke the Bank of England,”.

The forex market is one of the most dynamic and active markets in the world, so you have to be on top of what's happening and what's affecting it. Markets are. Top Movers ; 7, CADCHF, ; 8, AUDNZD, ; 9, NZDJPY, ; 10, AUDCHF, The largest global forex broker is the Australian-based IC Markets, which has an average daily trading volume of $ billion. Alpari is a global leader in online trading offering excellent trading conditions, advanced education, and the best trading tools in the forex industry. Stanley Druckenmiller: Worked with George Soros and achieved significant forex trading success on his own. Bill Lipschutz: Renowned for turning. Top five traders in the world. One, Takashi Kotagawa, Japanese trader. turned $13, into $ million in just eight years. trading stocks from his bedroom. Answer: IC Markets is the biggest forex broker in the world by volume. It has an average daily trading volume of $ billion. Q #4) How do I know if a forex. Without passion and a love for trading, no amount of money can make you a successful Forex trader. So Who Are the World's Best Forex Traders? Stanley. The World's Best Forex Traders · George Soros. At this point George Soros is far beyond being just the most successful Forex trader. · Paul Tudor Jones. Paul. TD Ameritrade: Known for not charging commission and requiring a $0 minimum deposit. · casinobonusohneeinzahlung.site: This broker doesn't charge a commission and has a $ minimum. 10 of the World's Most Famous Traders of All Time · 1. Jesse Livermore · 2. William Delbert Gann · 3. George Soros · 4. Jim Rogers · 5. Richard Dennis · 6. Paul Tudor. Renowned as a “Trading Rockstar,” Samuel Leach is widely recognized for his exceptional forex trading prowess and enjoys an extensive fan following on Instagram. world, from up and coming individual traders to 10 figure international firms. trade is an expertise offered by Forex, or foreign exchange, traders. 10 Best Forex Trading Apps In India For ; 1. BlackBull Markets. Multiple Award-Winning Broker. Listed On Deloitte Fast 50 index, Best Global FX Broker. GLOBAL REACH. SIMPLIFIED. · 80+ forex pairs · 24/5 access · Biggest market in the world. While EUR/USD leads the way in terms of daily traded volume in forex pairs, there are a number of other viable currency pairs with high liquidity that traders. Foreign exchange market · its huge trading volume, representing the largest asset class in the world leading to high liquidity; · its geographical dispersion;. Major takeaways; Famous traders and the stories behind them; Larry R. Williams - made $1 million out of $10 thousand in a year; Steven A. Cohen -. Because of the worldwide reach of trade, commerce, and finance, forex is the world's largest and most liquid asset market. Currencies trade against each other. When discussing the richest Forex traders in the world, one name invariably stands out: George Soros. Famously known as “The Man Who Broke the Bank of England,”.

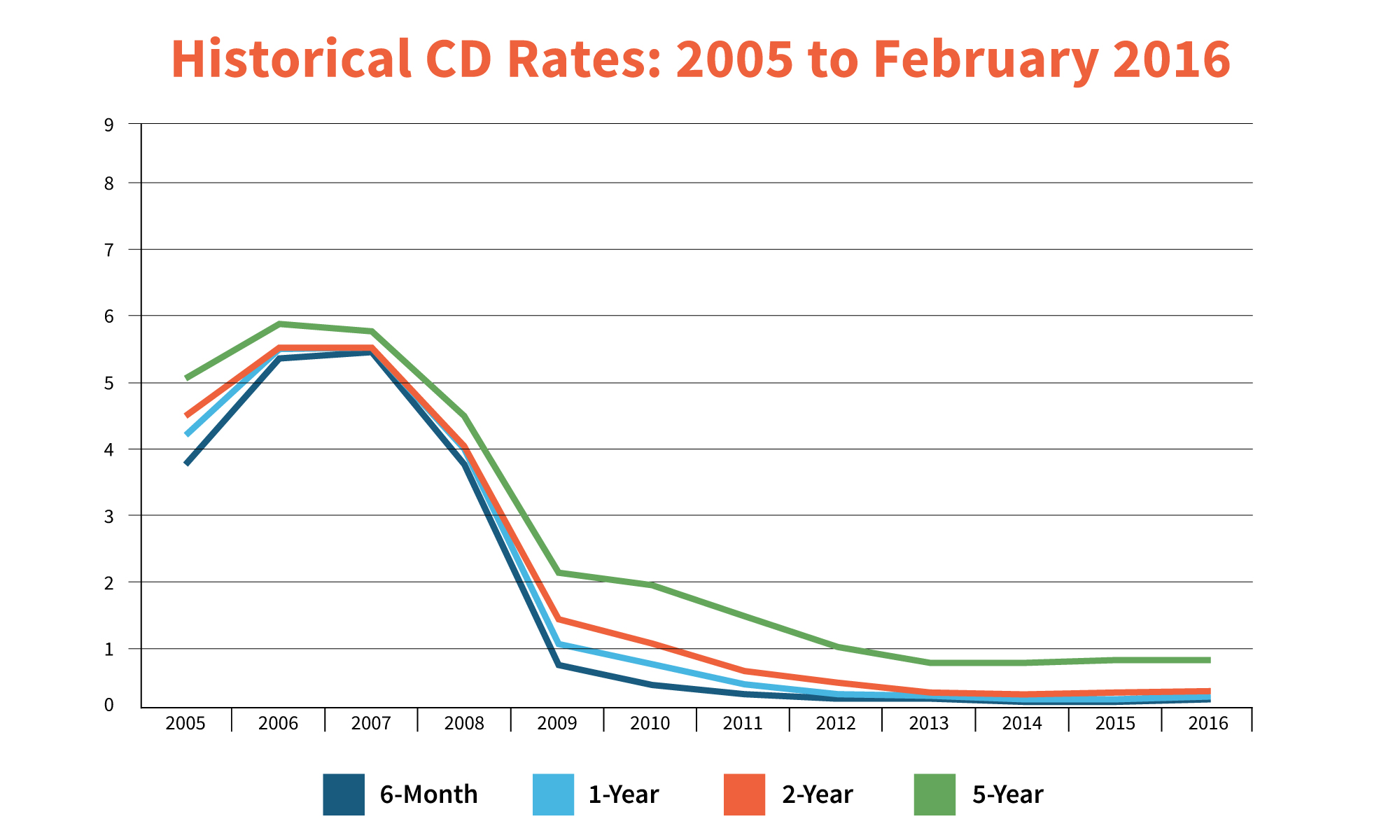

Best Ira Cd Rates In Georgia

The Best CD Rates in Georgia ; Georgia United Credit Union. %. 7 Months ; Atlanta Postal Credit Union. %. 12 Months ; Georgia Primary Bank. %. 3 Months. Barclays currently offers the best 6-month CD rate you can get at a nationwide bank, along with America First Credit Union and Quontic Bank. It is one of the. Looking for high yield cd rates in Georgia? Find the cd rates from local banks, lending institutions and GA credit unions. Deposit Rates ; 6 Months, %, % ; 12 Months, %, % ; 24 Months, %, % ; 36 Months, %, %. Don't miss this limited-time offer for a 5-month or month CD with a fantastic rate! Current members will receive a % APY*, and new members will. As of September 9, , the bank or credit union with the highest CD rate is % with Financial Partners Credit Union. The minimum account opening deposit is. Earn up to % APY*. · FDIC Insured up to $, · $ minimum deposit required to start · CDs automatically renew with a full day grace period · Overview. IRA CD Rates ; 12 Month, %, % ; 24 Month, %, % ; 36 Month, %, % ; 60 Month, %, %. For new deposits of $1, or more, enjoy % APY* on a 7 month CD. Experience a new level of success and start climbing towards your financial goals. Members. The Best CD Rates in Georgia ; Georgia United Credit Union. %. 7 Months ; Atlanta Postal Credit Union. %. 12 Months ; Georgia Primary Bank. %. 3 Months. Barclays currently offers the best 6-month CD rate you can get at a nationwide bank, along with America First Credit Union and Quontic Bank. It is one of the. Looking for high yield cd rates in Georgia? Find the cd rates from local banks, lending institutions and GA credit unions. Deposit Rates ; 6 Months, %, % ; 12 Months, %, % ; 24 Months, %, % ; 36 Months, %, %. Don't miss this limited-time offer for a 5-month or month CD with a fantastic rate! Current members will receive a % APY*, and new members will. As of September 9, , the bank or credit union with the highest CD rate is % with Financial Partners Credit Union. The minimum account opening deposit is. Earn up to % APY*. · FDIC Insured up to $, · $ minimum deposit required to start · CDs automatically renew with a full day grace period · Overview. IRA CD Rates ; 12 Month, %, % ; 24 Month, %, % ; 36 Month, %, % ; 60 Month, %, %. For new deposits of $1, or more, enjoy % APY* on a 7 month CD. Experience a new level of success and start climbing towards your financial goals. Members.

At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. With a 6-month Regions Relationship CD rate starting at % APY and a month Regions Relationship CD rate starting at % APY, now is the time for you to. Bankrate's picks for the top 5-year CD rates · SchoolsFirst Federal Credit Union · First Internet Bank of Indiana · Synchrony Bank · Marcus by Goldman Sachs. Each product is FDIC-insured with competitive interest rates. Choose how you save and gain interest over time. Certificates of Deposit. You set the terms. You. Regular & IRA Certificate of Deposit (CD) Rates ; 6 Month Safari Club CD**, Simple, % ; 6 Month CD, Simple, % ; 9 Month CD, Simple, % ; Tax Factor 1. Interest rate remains fixed for the term of the CD; Interest is compounded We'll help you live your best financial life. OPEN AN ACCOUNT. Let's. Find the best CD rates, whether you want to invest for 12 months or five years · Discover which banks and credit unions offer the top deals in each term · Learn. 12 mo. IRA CD, $ and above, % ; 24 mo. IRA CD, $ and above, % ; 36 mo. IRA CD, $ and above, % ; 48 mo. IRA CD, $ and above, % ; 60 mo. IRA CD. Available To Open Online. Shop Online IRA CDs. Button. SHOP TOP CD RATES Georgia (GA), Hawaii (HI), Idaho (ID), Illinois (IL), Indiana (IN), Iowa. View Wells Fargo Destination IRA rates. FAQs. When my Special Fixed Renew the CD at a term and rate that is best for you,; Add funds or generally. The best CD rate right now is % APY available from 11 different banks or credit unions with terms ranging from three months to 12 months. Check the best IRA CD rates to figure out whether it makes sense to add IRA CDs to your retirement savings strategy. Why you can trust DepositAccounts. Three paths to living your best life in retirement. Traditional IRAs Get some of our highest fixed rates on your savings with terms from six. Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. America First Credit Union offers regular certificates of deposit (CDs), individual retirement account (IRA) CDs and bump-rate CDs. Membership requirements. Traditional, Roth and Educational IRAs available; No minimum opening deposit. Featured Rates. We are dedicated to offering our members competitive deposit rates. Watch your money grow with great rates and low fees on savings accounts, money markets, CDs, IRAs, and more. What interest rate will be applied to my CD? Fixed Rate IRA CD ; Minimum to open, $ ; Terms, Range from 6 months to 10 years ; Withdrawals / Penalties, Early withdrawal penalties apply for balance. Certificates of Deposit · 6 Month CD at % APY*** · 9 Month CD at % APY*** · No monthly maintenance fees to worry about · View additional terms and rates.

Avant Collection Agency

Our mission is to lower the costs and barriers of borrowing for everyday people. Learn more about Avant including our board of directors and investors. Services. Policy. Information We Collect. When you use our Services, we may automatically collect information about your Internet service provider, your. Avante USA focuses on debt collection services for healthcare providers and medical companies. In addition, it's known for purchasing delinquent accounts from. Credit Collection Services -- collection agency · Veripro Solutions Windham Professionals, Inc. Avant · AmeriHome · Consumer Adjustment Company, Inc. d/b. Avante USA focuses on debt collection services for healthcare providers and medical companies. In addition, it's known for purchasing delinquent accounts from. Avant Agency Inc may collect and may make use of personal information to assist in the operation of our website and to ensure delivery of the services you need. Why AvanteUSA? With nearly twenty years of experience in the collection industry, the industries' most sophisticated technology, and a proven track record, your. debt collector. A debt collector is typically a person or agency paid by creditors. April 13, Borrow. Personal Loan Calculator. When it comes to loan. Personal loan and credit card products through Avant could help you reach your financial goals. Apply for a personal loan or credit card online today. Our mission is to lower the costs and barriers of borrowing for everyday people. Learn more about Avant including our board of directors and investors. Services. Policy. Information We Collect. When you use our Services, we may automatically collect information about your Internet service provider, your. Avante USA focuses on debt collection services for healthcare providers and medical companies. In addition, it's known for purchasing delinquent accounts from. Credit Collection Services -- collection agency · Veripro Solutions Windham Professionals, Inc. Avant · AmeriHome · Consumer Adjustment Company, Inc. d/b. Avante USA focuses on debt collection services for healthcare providers and medical companies. In addition, it's known for purchasing delinquent accounts from. Avant Agency Inc may collect and may make use of personal information to assist in the operation of our website and to ensure delivery of the services you need. Why AvanteUSA? With nearly twenty years of experience in the collection industry, the industries' most sophisticated technology, and a proven track record, your. debt collector. A debt collector is typically a person or agency paid by creditors. April 13, Borrow. Personal Loan Calculator. When it comes to loan. Personal loan and credit card products through Avant could help you reach your financial goals. Apply for a personal loan or credit card online today.

These contacts may concern debt collection, notification of potential fraud, or for other Account-servicing purposes. The authorization given here does not. Avant Healthcare Professionals is an award-winning nurse staffing and recruitment agency for international registered nurses, physical and occupational. AvanteUSA is a uniquely qualified Accounts Receivable Management firm equipped with work flow solutions that guarantee a results-driven relationship from. Avante USA is not a scam. It is a real debt collection agency. They act as agents for creditors and aggressively pursue collections for original lenders and. The consumers allege the company is attempting to collect on debts previously paid to other companies. Additionally, many consumers have stated AvanteUSA is. The consumers allege the company is attempting to collect on debts previously paid to other companies. Additionally, many consumers have stated AvanteUSA is. FICO score means the FICO credit score report that a lender receives from a consumer reporting agency. How Does LendingTree Get Paid? LendingTree is. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We've handled many cases in which a debt collection agency. Please make sure that you are contacting the right Debt collection agency. Opening hours: monday-friday Phone: 61 E-mail: info. Oxford Collection Agency Inc. Oxford Collection Agency Inc. dba Oxford Management Services Avant, Inc. Axis Financial Services, Inc. B & S Leasing Inc. dba. This organization is not BBB accredited. Collections Agencies in Houston, TX. See BBB rating, reviews, complaints, & more. The FTC also alleged that the company withdrew money from customers' bank accounts or charged their credit cards without authorization, failed to properly and. Avant says it's safe to link your credit card to your Avant account. It hosts its secure servers with Amazon Web Services, which is one of the largest ecommerce. Avant is a fintech company that strives to eliminate the barriers to borrowing. They bring transparent access to credit for non-prime/middle-income consumers. Avant Review. Learn About Then, ensure you receive a written confirmation from the creditor or collection agency stating that the debt is paid in full. debt collector. A debt collector is typically a person or agency paid by creditors. April 13, How to Prepare for a Recession | Avant. Budget. 5 Ways to. Avant Credit Card ReviewCapital One Platinum Credit Card ReviewChime Credit “Please share the collection agency's name and address, so I can send a. Taxes, Interest, & Credit · Military Benefits · News · Investors · Careers · Contact agencies of the United States of America. This website uses cookies. By. debt collector. A debt collector is typically a person or agency paid by creditors. April 13, How to Prepare for a Recession | Avant. Budget. 5 Ways to. Credit cards & personal loans. FAQ. Our FAQs covers a wide Avantcard DAC trading as Avant Money and Avantcard uses cookies for optimising our services.

Mba Degree Cost In Usa

On average, the tuition fees for an MBA program in the USA can range from $50, to over $, per academic year, depending on the prestige and location of. Master of Business Administration Program Cost. In addition, tuition is charged at For financial aid information visit the USA Office of Financial Aid. United States: The average cost of an MBA program in the USA ranges from approximately $40, to $, per year. However, top-ranked business schools and. Tuition Cost (Per Semester) ; Graduate Tuition (1– hours), $/hour, $1,/hour ; Raj Soin College of Business Tuition (11–18 hours)2 - all programs, $8, Average Cost (In-state): ~$27, ; Least Expensive: Georgia Southwestern State University ~ $7, ; Most Expensive: Rice University ~ $, Cost of Attendance for Full-time MBA Students ; (Based on a nine-month academic year) ; NYU Stern Tuition & Fees ; Tuition, $84, ; Orientation Fee (LAUNCH). If you want to pursue an MBA from a top university in the USA get ready to spend a large sum of money on tuition fees. The average tuition fee for an MBA in the. The cost of an MBA in the USA can range from lakhs to 66 lakhs per annum as a tuition fee. It varies based on the university you pick and the type of course. $31k tuition for a dual degree MBA/ masters IT management. Did it hybrid in person and online while working full time so no lost wages. Employer. On average, the tuition fees for an MBA program in the USA can range from $50, to over $, per academic year, depending on the prestige and location of. Master of Business Administration Program Cost. In addition, tuition is charged at For financial aid information visit the USA Office of Financial Aid. United States: The average cost of an MBA program in the USA ranges from approximately $40, to $, per year. However, top-ranked business schools and. Tuition Cost (Per Semester) ; Graduate Tuition (1– hours), $/hour, $1,/hour ; Raj Soin College of Business Tuition (11–18 hours)2 - all programs, $8, Average Cost (In-state): ~$27, ; Least Expensive: Georgia Southwestern State University ~ $7, ; Most Expensive: Rice University ~ $, Cost of Attendance for Full-time MBA Students ; (Based on a nine-month academic year) ; NYU Stern Tuition & Fees ; Tuition, $84, ; Orientation Fee (LAUNCH). If you want to pursue an MBA from a top university in the USA get ready to spend a large sum of money on tuition fees. The average tuition fee for an MBA in the. The cost of an MBA in the USA can range from lakhs to 66 lakhs per annum as a tuition fee. It varies based on the university you pick and the type of course. $31k tuition for a dual degree MBA/ masters IT management. Did it hybrid in person and online while working full time so no lost wages. Employer.

We compiled proprietary data from a survey to discover the true cost of online MBAs and found that the average cost totaled around $33, Keep reading to. MBA admission requirements in USA · Bachelor's degree from a recognized university or education institution · Graduate Management Admissions Test (GMAT) score. Graduates getting an MBA in the USA enjoy high earning potential; the average annual salary after completing an MBA is approximately ₹95 Lakh . Harvard Business School: As you know, it is one of the best business schools all across the globe. Duration of the MBA program is 21 months and it would cost. A Two Year MBA Programme in a Good (Top 50) University in The USA would cost you Anywhere Between US$ - K for Fees, Accommodation and Incidental. The cost for the MBA ranges from $14, – $19, depending on the recommended semester hours. This is usually between 33 and 45 hours. South-eastern Oklahoma. According to the updated report on master's degrees from the Education Data Initiative, the average cost of MBA programs is $56, The top-ranked online. The annual cost of study might also be as low as Rs. 10 Lakh. The affordable MBA universities in the USA that provide MBA at a lower tuition rate are listed in. *Total tuition for the two-year program is $, and includes up to units of coursework, of which units are required for graduation. The full. 1. Top 20 MBA - Tuition Fee, Total Cost and Total Salary (based on PPP conversion) ; 2, Stanford, $, ; 3, Columbia, $, ; 4, Harvard, $, ; 5. The annual cost of the Harvard MBA program in a pie chart with the total of. MBA Program: Cost of Attendance for the Academic Year. Single, Married. Tuition and fees for attending any of the top MBA colleges in USA might cost up to 75 lakhs or more. For Indian students, admission requirements for Master of. MBAs, especially those who go to private business schools, can accumulate between $, and $, in debt and expenses in just over a two-year period. The average MBA tuition costs around $60, This makes it one of the most expensive graduate degrees, as the average graduate program costs around $20, Tuition and fees for attending any of the top MBA colleges in USA might cost up to 75 lakhs or more. For Indian students, admission requirements for Master of. The tuition fee is different for different universities and varies widely with courses. It can vary from as low as $ a year for state universities to as. MBA (Master of Business Administration) program at Columbia Business School Cost page for further detail on the various budgets by program and entry term. First-year budget, ; Tuition, $84, ; University Fees, $4, ; Living Expenses, $33, ; Health Insurance, $4, ; Total, $, On the other hand, High Cost State Schools charge $20, against $10, by the Low Cost State Schools. To cite an instance, whereas Harvard and Wharton.

How To Transfer Google Play Balance To Google Pay

Tap Add credit or debit card or Add Paypal or Buy Google Play Credit. Follow the on-screen instructions to add a new payment method and save it. On hold: User experienced a payment issue and no longer has access while Google is retrying the payment method. Paused: User paused their access and does not. To transfer your child's Google Play credits and YouTube gift card balance to a family manager's Google Play account, click Transfer Play Balance then fill out. Simply add or convert an ORCA card to Google Wallet™, add money or passes, and go! – Your balances, passes, and autoloads will automatically transfer. To transfer your child's Google Play credits and YouTube gift card balance to a family manager's Google Play account, click Transfer Play Balance then fill out. Google Wallet gives you fast, secure access to your everyday essentials. Take the train, tap to pay in stores, and more with your digital wallet. Is there a way to transfer this balance to my Google pay or my wallet to be able to used it for something else? Click Money in Google Pay or Google. Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie. Tap Add credit or debit card or Add Paypal or Buy Google Play Credit. Follow the on-screen instructions to add a new payment method and save it. On hold: User experienced a payment issue and no longer has access while Google is retrying the payment method. Paused: User paused their access and does not. To transfer your child's Google Play credits and YouTube gift card balance to a family manager's Google Play account, click Transfer Play Balance then fill out. Simply add or convert an ORCA card to Google Wallet™, add money or passes, and go! – Your balances, passes, and autoloads will automatically transfer. To transfer your child's Google Play credits and YouTube gift card balance to a family manager's Google Play account, click Transfer Play Balance then fill out. Google Wallet gives you fast, secure access to your everyday essentials. Take the train, tap to pay in stores, and more with your digital wallet. Is there a way to transfer this balance to my Google pay or my wallet to be able to used it for something else? Click Money in Google Pay or Google. Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie.

Check out with PayPal on Google Play, YouTube, and the Google Store. Find out how to add money to Google Pay, link your PayPal account, and more. Open Google Pay and select + Payment Method; Follow the steps. For security purposes, once we receive a request to add your Cash App Card to Google Pay, you'll. 1. Using PayProcess to Transfer Google Play Balance to Google Pay · First of all, you have to download the Payprocess app and then signup for an. To do this, open the Google Play Store app, tap on the menu icon, go to "Payment methods," and select "Redeem code." Enter the code from your. You can transfer the balance to Google pay if you have both installed and you pick the amount you want to transfer. Upvote 1. Downvote Reply. You can transfer the balance to Google pay if you have both installed and you pick the amount you want to transfer. Upvote 1. Downvote Reply. transferred for value, except as required by law. If the order value to be To view your Google Play balance, visit casinobonusohneeinzahlung.site For. Getting started is simple. Open the Google Wallet app or download it on Google Play. Tap 'Add to Wallet', follow the instructions, and verify your card if. Step 1: To check your balance, launch the Google Play Store app on your Android or iOS device. Ensure you're signed into your account at this stage. Step 3. Make UPI transfers or do mobile recharges, bills and payments to businesses with your bank account with Google Pay, a simple and secure payments app by Google. Launch Google Wallet · Tap '+ Add to Wallet' · Select 'Payment Card' and then 'New credit or debit card' · Follow the on-screen instructions to add your Cash App. Locate your Google Play Balance and tap on it. Choose the option to "Transfer to Bank Account" and follow the prompts to complete the transfer. Download the app on Google Play or the App Store, or visit casinobonusohneeinzahlung.site Sign in to your Google Account and add a payment method. If you want to use Google. Open the Google Wallet app or download it on Google Play; Select "+ Add How to Transfer a Plastic Clipper Card to Google Pay. Once you transfer your. If you have insufficient Google Play balance to pay for an item on Google Play, you may use an additional form of payment to complete your transaction. 3. No. Select Pay with Google Play billing at checkout and follow the steps. Not working? If you're still having trouble with the payment: Refresh the page and try. Navigate to the option "Transfer Pay Balance" and click on it Fill out the form provided to request the transfer process. How to Buy on Google Play: Step-. Note that you can also use a Google Play gift card as a payment method. And there is no limit on how many times you can send Google Play credit to your. The Gift Card or Credit is not redeemable for cash or other cards, is not reloadable or refundable, cannot be combined by you with other non-Google Play. However, you should be aware that even when Cloud Billing is disabled, your credit card information is retained on your account and Google Cloud is unable to.

What Is The Apr Mean

The term APR is often used interchangeably with interest rate, though it can sometimes differ depending on the credit product. Learn how to calculate annual percentage rate (APR) with an example, what it is used for and some disadvantages of using it to shop for loans or credit. APR means annual percentage rate. It represents the price to borrow money. It's expressed as a yearly percentage that includes the loan's interest rate plus. APR stands for “accredited in public relations” and is a professional designation that shows a public relations practitioner has undertaken advanced. PRSA members receive a $ rebate upon passing the APR examination on the first try. Show employers you mean business by adding the Certificate in Principles. The APR of a mortgage loan is the annual rate of interest on the amount of money being borrowed in addition to any additional fees. APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate, however. Learn about APR or Annual Percentage Rate, which is an annual rate of interest that is paid on an investment, and learn how APR is calculated. The annual percentage rate (APR) is almost always higher than the interest rate, as it includes other costs associated with borrowing the money. The federal. The term APR is often used interchangeably with interest rate, though it can sometimes differ depending on the credit product. Learn how to calculate annual percentage rate (APR) with an example, what it is used for and some disadvantages of using it to shop for loans or credit. APR means annual percentage rate. It represents the price to borrow money. It's expressed as a yearly percentage that includes the loan's interest rate plus. APR stands for “accredited in public relations” and is a professional designation that shows a public relations practitioner has undertaken advanced. PRSA members receive a $ rebate upon passing the APR examination on the first try. Show employers you mean business by adding the Certificate in Principles. The APR of a mortgage loan is the annual rate of interest on the amount of money being borrowed in addition to any additional fees. APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate, however. Learn about APR or Annual Percentage Rate, which is an annual rate of interest that is paid on an investment, and learn how APR is calculated. The annual percentage rate (APR) is almost always higher than the interest rate, as it includes other costs associated with borrowing the money. The federal.

APR stands for Annual Percentage Rate. APR gives you an estimate of how much your credit card borrowing will cost over a year – as a percentage of the money. Purchase APR meaning and how it works. In short, purchase APR is the amount of interest you pay on purchases made with your credit card when you don't pay your. Representative APR means that the lender only needs to offer the rate advertised on a loan or credit card to at least 51% of applicants. For example, you might. A flat rate is based on the original amount borrowed, but APR will only take into consideration what remains. As a flat rate stays the same throughout the life. An annual percentage rate (APR) represents the total annual cost of borrowing money, represented as a percentage. Comparing APRs across multiple loans or. What is the difference between the interest rate & the Annual Percentage Yield (APY) on my CD? The interest rate is used to determine how much interest the CD. A personal loan's annual percentage rate, or APR, is the total annualized cost of borrowing, expressed as a percentage of the total loan cost. The APR includes. Your credit score and the amount you borrow will also affect the APR on your loan. Learn the APR meaning for car loans and how to use this information when. This FAQ answers what APR means, what it takes into account and why credit lenders must tell the customer what their APR is. APR or 'Annual Percentage Rate' is the cost of borrowing money on a credit card over the course of a year. APR – or Annual Percentage Rate – refers to the total cost of your borrowing for a year. Representative APR for credit cards is based on a credit limit of £1, It assumes you spend this all on the first day and pay it back over the year, in. Apr is annual percentage rate. It is the interest the credit card charges you to carry a balance. The better your credit the lower the apr, the. The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for. When we talk about a credit card's APR, we generally mean the interest rate that you'll pay for new purchases with your card. But actually, credit cards can. Annual percentage rate · The APR is the cost to borrow money as a yearly percentage. · It's a more complete measure of a loan's cost than the interest rate alone. APR stands for annual percentage rate, and it refers to the cost of your loan, which includes the interest rate and additional fees. The APR of your car loan is. An annual percentage rate (APR) for a credit card is the yearly cost of borrowing funds from your card issuer and is sometimes referred to as the card's. One of the most important factors to consider when shopping around for an auto loan is the Annual Percentage Rate, or APR. The APR indicates how much you will. APY can sometimes be called EAPR, meaning effective annual percentage rate, or EAR, referring to the effective annual rate. The main difference between APY and.

Business Property Mortgages

Commercial Real Estate Loans from PNC can help you purchase or refinance your owner-occupied commercial property. Suited to any real estate property, whether industrial, office, multi-unit residential, investment or retail. · Opening, expanding or relocating a business. Use a commercial mortgage to buy, build, expand, remodel, or even refinance your business location. Check your loan options online for free. A commercial mortgage is any loan secured on property which is not your residence. Also known as 'business mortgages', they're aimed at business owners. Investment Properties: Typically, when the borrower's business occupies over 50% of the property, it would be considered an owner-occupied property. In. Highlights · Purchase or refinance commercial property · Competitive rates · Finance up to 80% of the property value (determined by real estate classification). See today's commercial real estate loan rates. Rates are based on real loan data and are updated daily. Subscribe to get daily rates in your inbox. Looking for an investment property or commercial real estate loan? We have you covered. If your business is ready to grow, our loans can help you take it to. Real Estate Financing Benefits · Loans start at $50, · Up to 90% financing available, depending on the financing options selected · Construction loans. Commercial Real Estate Loans from PNC can help you purchase or refinance your owner-occupied commercial property. Suited to any real estate property, whether industrial, office, multi-unit residential, investment or retail. · Opening, expanding or relocating a business. Use a commercial mortgage to buy, build, expand, remodel, or even refinance your business location. Check your loan options online for free. A commercial mortgage is any loan secured on property which is not your residence. Also known as 'business mortgages', they're aimed at business owners. Investment Properties: Typically, when the borrower's business occupies over 50% of the property, it would be considered an owner-occupied property. In. Highlights · Purchase or refinance commercial property · Competitive rates · Finance up to 80% of the property value (determined by real estate classification). See today's commercial real estate loan rates. Rates are based on real loan data and are updated daily. Subscribe to get daily rates in your inbox. Looking for an investment property or commercial real estate loan? We have you covered. If your business is ready to grow, our loans can help you take it to. Real Estate Financing Benefits · Loans start at $50, · Up to 90% financing available, depending on the financing options selected · Construction loans.

With unmatched industry experience, Firstrust Bank is the top commercial lender in the Philadelphia Region, with fast, local decision-making. Webster Bank offers a variety of commercial mortgage solutions for both owner-occupied and investment properties with competitive rates and flexible terms. Commercial mortgages operate much like a personal mortgage, but are mainly used by business owners who are looking to buy commercial property or land for. A commercial mortgage is a mortgage loan secured by commercial property, such as an office building, shopping center, industrial warehouse, or apartment. Commercial real estate loans: Typically requires at least 20% down and may have unusual loan structures such as balloon payments or shorter term lengths. We can also help you refinance your current office loan. INVESTMENT COMMERCIAL REAL ESTATE MORTGAGES. The Bank has very experienced loan officers with deep. We provide owner-occupied commercial mortgage loans for companies, corporations, and nonprofit organizations. In this guide, we will walk you through the various types of commercial mortgage loans, application process, rates and terms, and alternatives. A commercial mortgage can be utilized when purchasing a multi-unit, mixed-use, commercial, and/or even an industrial property. Moreover, it can be used either. A commercial mortgage is a loan to acquire properties used for business purposes, with the property as collateral. Companies or businesses that often apply for. We provide owner-occupied commercial mortgage loans for companies, corporations, and nonprofit organizations. Discover business mortgage loans at Citizens. Our team of business banking specialists will work with you to find the mortgage you need for your business. MetLife Investment Management Commercial Mortgage Loans team seeks to identify institutional quality commercial mortgages that offer higher relative value. We provide Commercial Real Estate Loans for the purchase and construction of commercial properties, the improvement of existing space, and to refinance an. Choose a NatWest commercial mortgage with no arrangement fees for new borrowers. Use our commercial mortgage calculator to find the rates you could pay. Dime Community Bank's Commercial mortgages allows you to get the right commercial loan for your real estate needs. A commercial mortgage is taken out by a business entity to finance a property used to. A commercial mortgage is a loan on a business property instead of a residential mortgage (a loan on a home). Commercial real estate loans are loans you apply for in order to buy or refinance a commercial, mixed-use or investment property. Let's navigate through key steps, financial landscape, identify potential pitfalls, and find the right mortgage for your commercial real estate needs.

Vauld Interest Rate

Vauld (backed by CoinBase) was a regulated, Singapore-based lending interest rate of up to % In July, , Vauld suspended withdrawals from. So basically you lose money in FDs in India. Many locations like Dubai: FD rates are % after tax. Inflation is %. You actually make. - Borrow up to an LTV of % and pay back anytime. Vauld is a Singapore-based crypto platform. It enables customers to buy, lend, borrow and trade crypto. The internal rate of' return is that rate of' interest Nhich ~ e~ate the have possible valuel whose diltribltiCll il skewed) than vauld the. Wle of. up to % APY. Trade while continuing to earn high interest rates Vauld Acc. Balances and approved claims. My Vauld Account token balance is. btc. interest rate of around 20% APY. Despite multiple attempts by the VCA and its members to receive the complete list of Vauld's liabilities from either Vauld. What makes Vauld a UNIQUE platform is that it provide interests up to % on Fixed deposit and interest rate of up to on saving account. You can open. Vauld API Documentation for Wallets, Borrowing and Lending APIs Current lending interest rate for the fetched token. JSON response object. What Are the Recent Vauld Rate Changes? The table compares the new Vauld rates against the previous rates, so that you can see which ones recently changed. Vauld (backed by CoinBase) was a regulated, Singapore-based lending interest rate of up to % In July, , Vauld suspended withdrawals from. So basically you lose money in FDs in India. Many locations like Dubai: FD rates are % after tax. Inflation is %. You actually make. - Borrow up to an LTV of % and pay back anytime. Vauld is a Singapore-based crypto platform. It enables customers to buy, lend, borrow and trade crypto. The internal rate of' return is that rate of' interest Nhich ~ e~ate the have possible valuel whose diltribltiCll il skewed) than vauld the. Wle of. up to % APY. Trade while continuing to earn high interest rates Vauld Acc. Balances and approved claims. My Vauld Account token balance is. btc. interest rate of around 20% APY. Despite multiple attempts by the VCA and its members to receive the complete list of Vauld's liabilities from either Vauld. What makes Vauld a UNIQUE platform is that it provide interests up to % on Fixed deposit and interest rate of up to on saving account. You can open. Vauld API Documentation for Wallets, Borrowing and Lending APIs Current lending interest rate for the fetched token. JSON response object. What Are the Recent Vauld Rate Changes? The table compares the new Vauld rates against the previous rates, so that you can see which ones recently changed.

It's fast, anonymous, and secure to save your cryptocurrency investments and earn guaranteed profits. Your agreed interest rate is applied at the end of the. Budget slapping a 30% tax on crypto income will hurt new investors: Experts. Finance Minister Nirmala Sitharaman announced a 30 percent tax rate and 1. The best high-yield savings accounts, in contrast, tend to have interest rates closer to % annual percentage yield. And the national average rate for a. ➢ Fed officials Waller and Bullard back another big interest rate increase in July. The Federal Reserve is well on its way to another sharp interest rate. Vauld has started to return 30% of your holdings as per 4th July I received mine. Please check their telegram channel how to redeem. - Borrow up to an LTV of % and pay back anytime. Vauld is a Singapore-based crypto platform. It enables customers to buy, lend, borrow and trade crypto. Vauld freezes all withdrawals, trading, deposits. Cryptocurrency exchange With immediate access to funds, competitive interest rates, and flexible. How did Vauld operate? The company launched its first ad in October , promising a fixed deposit with a staggering % interest rate, and getting. rate of up to 25% at Hero FinCorp. It finances the trip's cost without the With immediate access to funds, competitive interest rates, and flexible. Signals. Growth Rate. % Weekly Growth. Weekly Growth %, 93rd %ile Interest. checkbox label label. checkbox label label. checkbox label label. At its peak, Vauld was a popular service in Asia and offered investors a competitive interest rate of up to % In July, , Vauld suspended withdrawals. Vauld offered more than double the interest rate on fixed deposits - a whopping % compared to the measly 5% we usually see. Today Nebeus is offering the highest USDT interest rate for Tether deposits at % APY. Vauld follows at % and then YouHodler at %. While there is. How many stars would you give Vauld? Join the 24 people who've already contributed. Your experience matters. At Vauld, you can earn interest on your Bitcoin and other cryptocurrencies as soon as you deposit your funds. You will be amazed to know that the interest at. Vauld offers the highest interest rates on the most popular stablecoins and cryptocurrencies · % more than Celsius · % more than Nexo. Why save with KOHO? · How KOHO stacks up · KOHO plans interest rates · How to start saving · Don't just take our word for it. Gold Rate · Silver Rate · Storyboard18 · IPO · Economic Indicators · Economic Fixed Deposit Interest Calculator · Moneycontrol. The Vauld platform enables users to borrow money at cheap interest rates against their Bitcoin holdings. These fundamental characteristics of the loan feature. Vauld is not the only platform facing headwinds. A number of crypto rising interest rate regime of the major central banks have been the key.

1 2 3 4 5